Should You Use Home Equity to Invest in Real Estate?

Generally speaking, it’s best to avoid debt as much as possible. After the Bible says it’s best to lend out freely without needing to borrow for yourself (Deuteronomy 15:6).

Of course, the Bible also says to forgive all debts after seven years. That’s certainly antithetical to our current financial system.

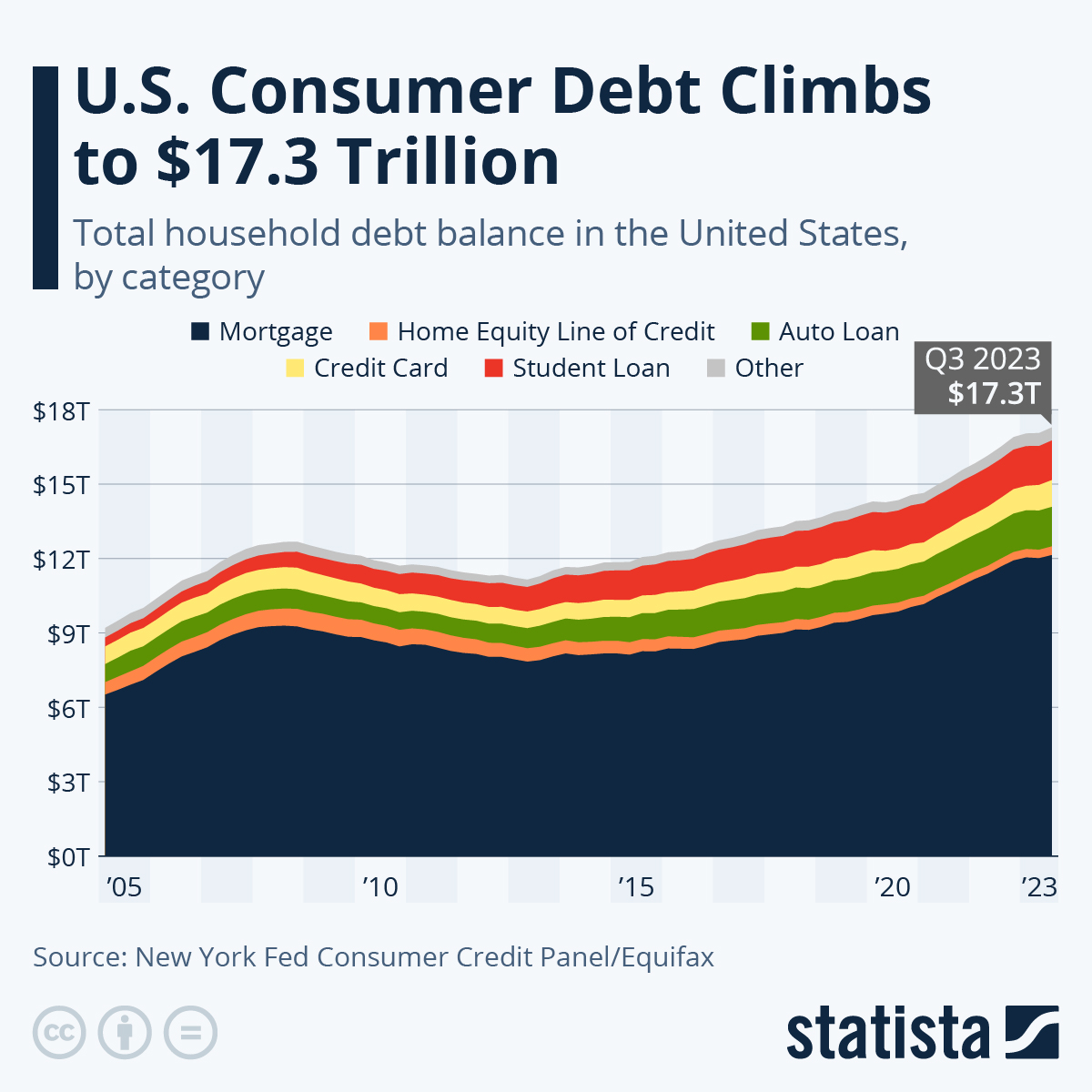

Our society relies on debt. According to the New York Federal Reserve’s Quarterly Report on Household Debt and Credit, total household debt reached a record high of $17.05 trillion in the first quarter.

That’s nearly $3 trillion more than we owed in the fourth quarter of 2019, shortly before the COVID pandemic upended everything.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

As you can see, most of that debt isn’t due to credit cards or student loans. It’s mortgage debt.

Most homeowners today spend much of their adult lives paying off 30-year mortgages.

And while mortgage debt is often referred to as “good debt” — because you’re investing in an asset that will improve your overall financial scenario — it’s still money that you owe to someone else.

A Way to Wisely Use Debt?

However, there are ways to take advantage of our debt culture wisely.

If you’re considering investing in a second property, you may be wondering whether to use a home equity line of credit (HELOC) or a home equity loan.

Using home equity can be an attractive option for homeowners looking to expand their real estate portfolios.

By tapping into the value of your current home, you can secure financing with favorable interest rates.

Using a HELOC or home equity loan as a down payment on a second property also allows you to buy the new property while still owning your original home.

Read This Story: Rental Property Investing: Your Paycheck for Life

You could rent out one of the properties for passive income. Doing so could help you pay off your mortgage faster or even cover some of your living expenses.

Both HELOCs and home equity loans allow homeowners to access the value of their properties. But they each come with different risks and benefits.

HELOCs vs. Home Equity Loans

Lump-sum home loans are fairly straightforward. When you take out a loan, the total amount is immediately paid to you.

However, with HELOCs, or home equity lines of credit, you can withdraw only as much money as you need. It’s kind of like an enormous credit card.

A HELOC lender will give you a line of credit, but you’re not obligated to use all the funds at once. You can draw only the funds you need at the moment — and pay interest only on the amount you’ve borrowed.

A HELOC can be a good option if you have a large percentage of your mortgage paid off and are a careful spender who likes to prepare for emergencies.

It can also be an excellent choice if you’re ready to branch out into a wise investment — real estate — that you’re confident will yield great returns.

Read This Story: Know Your Risk and Reward

But there are drawbacks to HELOCs.

With a HELOC, your minimum monthly payments consist solely of the interest you owe so far. That means, if you make only your monthly minimum payments, at the end of your draw period — typically, five to 10 years — you’ll still owe the amount you borrowed.

After the draw period, if there’s still a balance due, borrowers typically transfer it to a traditional loan or even refinance the original HELOC with another one.

HELOCs also have very high, variable interest rates. Currently, the average rate for a home equity line of credit is 8.16%, but rates can go as high as 10%. And they’re subject to change.

Although interest rates for lump-sum home equity loans are similar, they’re fixed. That means you won’t have to gamble on the direction interest rates are going.

The Bottom Line

Investing in real estate always carries risks. The market may not perform as expected, resulting in lost money instead of profits.

Furthermore, using home equity for investments means taking on more debt. And that comes with its own set of risks and responsibilities.

Before pursuing this strategy, ensure that you have sufficient income and savings to comfortably manage the additional monthly payments.

Ultimately, deciding whether or not to take on debt requires weighing the potential benefits against the associated risks and ensuring that borrowing aligns with your overall financial goals and situation.

As always, it’s essential to have realistic expectations and do thorough research before making any financial decisions.

Editor’s Note: We could be facing a tectonic upheaval in the financial world that shakes out the winners from the losers. Our colleague Dr. Stephen Leeb has pinpointed a way to not only survive this upheaval but also thrive from it.

Dr. Leeb is the chief investment strategist of The Complete Investor, a trading service on which Scott Chan is the lead analyst.

In conjunction with Scott Chan, Dr. Leeb has found an obscure investment that’s poised to reap outsized gains from the paradigm shift ahead. Click here for details.

Freelance writer Jennifer Andruchuk contributed reporting for this article.