Crypto Roundup: Coinbase Makes History, Shopify’s Game-Changing Partnership, And More

As the sun rose over Jackson Hole, Wyoming on Friday morning, all eyes were on Federal Reserve Chairman Jerome Powell.

In his keynote speech at the Kansas City Fed’s Symposium, Powell noted that rates will remain high until inflation sufficiently slows.

Oh, and don’t rule out further rate increases in the future, either.

If they think it’s appropriate, they’ll do it — carefully, of course.

While Wall Street had its predictable jitters this week leading up to the speech. And the crypto market seemed to respond in kind, with Bitcoin sliding roughly 10% in a week.

In the meantime, there was plenty of action in the realm of cryptocurrency over the past week. So strap in as we break down the week’s crypto news. Let’s get started!

🥇 Coinbase Breaks New Ground

Coinbase (Nasdaq: COIN) has finally clinched the green light to list crypto futures in the U.S., a significant move that’s been in the works for nearly two years. Approval to operate as a Futures Commission Merchant (FCM) was granted by the National Futures Association (NFA). For those not in the know, FCMs play a pivotal role in buying or selling futures contracts, sort of like market makers.

This approval sets Coinbase apart as the inaugural crypto-centric platform in the U.S. to offer regulated and leveraged crypto futures alongside its traditional spot trading offerings. The bigger picture? Andrew Sears, CEO of Coinbase Financial Markets, put it best, stating that providing U.S. investors with access to secure and regulated crypto futures is a game-changer. Following the announcement, shares of COIN opened 4% higher. (The stock has more than doubled this year after hitting all-time lows following the collapse of FTX.)

🛍️ Shopify + Solana = Power Move

This week, e-commerce titan Shopify (Nasdaq: SHOP) announced that it would integrate Solana Pay, allowing merchants on its platform to accept payment with cryptocurrency.

For starters, payments will be made via USDC, which those of you who tuned in last week know is a stablecoin tied to the U.S. dollar. For those who didn’t, here’s the short version: USDC is the second-largest stablecoin, regulators are warming up to it, and it promises to provide the stability of the U.S. dollar within the crypto ecosystem (all reasons why it’s becoming a top choice for both merchants and consumers).

Solana is a high-performance blockchain known for its efficient decentralized applications and smart contracts. And if everything goes according to plan, this partnership will offer a cost-effective alternative to traditional payment methods. Transaction fees will be a fraction of a penny and settle nearly instantly — compared to credit card processing fees, which can cost as high as 3.5% and take up to two days to settle.

Not only could it lead to cost savings for businesses, but it could also help with the innovation of crypto-based loyalty schemes, like NFT rewards.

Why This Matters

Add it all up, and this is a pretty big deal. Shopify is responsible for a whopping 10% of the U.S. e-commerce market. It’s previously dabbled in crypto, but this recent move with Solana could be a game-changer, potentially driving wider crypto adoption and setting the stage for more mainstream crypto-based transactions.

Pantera Makes A METAL Bitcoin Prediction 🎸🤘

No, Pantera isn’t releasing a new album (although that would be awesome). The legendary metal band shares a name with Pantera Capital, a leading blockchain investment firm. And this week, they made a bold prediction:

Bitcoin could hit $148,000 by July 2025.

Considering BTC recently closed a hair above $26,000, that sounds bonkers, right? But consider this…

The forecast is based on the historical impact of Bitcoin’s “halving” events. For those not in the loop, a “halving” is like Bitcoin’s version of a stock split, but with a twist.

As we’ve covered in the past, Bitcoin mining involves receiving a reward (in the form of BTC) for validating new transactions on the blockchain. Well, every four years, the rewards miners receive are cut in half. (Get it?)

Now, keep in mind there will only ever be 21 million Bitcoins. As of now, about 18.8 million have been mined, leaving a limited supply to be mined. This scarcity is part of what gives Bitcoin its value.

This “halving” effectively reduces the rate at which new Bitcoins are created and released into circulation. Historically, these halving events have led to significant price surges due to the reduced supply of new coins.

Pantera’s prediction considers the next halving event, expected in 2024, and the subsequent supply squeeze. Here’s the juicy part:

“The next halving is expected to occur on April 20, 2024. Since most bitcoins are now in circulation, each halving will be almost exactly half as big a reduction in new supply. If history were to repeat itself, the next halving would see bitcoin rising to $35k before the halving and $148k after.”

Source: Pantera Capital

Another Bearish Technical Sign For Bitcoin 📉🐻

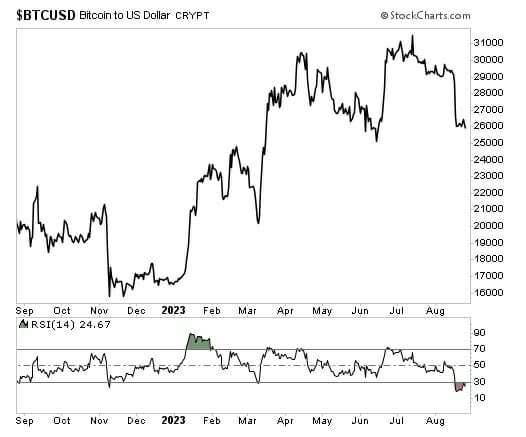

Alex Kuptsikevich, a senior market analyst at FxPro, noted that Bitcoin’s trend appears decidedly bearish. The cryptocurrency recently dipped below its 200-week and 200-day moving averages, signaling a potential shift to a bearish trend. (At this time, Bitcoin was trading around $26,000.)

And if that weren’t enough, another key technical indicator shows that Bitcoin is experiencing the most extreme oversold conditions since the COVID-19 market crash in March 2020.

I’m talking about the relative strength index (RSI). This momentum indicator gauges an asset’s recent price movement relative to its average over a set period (typically 14 days). Interpreting RSI is pretty straightforward — a reading above 70 indicates an “overbought” condition, while a reading below 30 indicates “oversold.”

After last week’s crypto “flash crash” and this week’s continued softness, Bitcoin’s RSI has plummeted well below 30. It’s important to note that an “overbought” or “oversold” condition can remain that way for a while, but it suggests that Bitcoin’s price has fallen too rapidly.

As the adage goes, it’s always darkest before the dawn.

Crypto Tip of the Week: HODL, Explained

If you’re new to the crytpo world, you’ve probably noticed that there’s a fair bit of slang that gets thrown around. One term you may have seen is “HODL”.

Originally derived from a misspelling of the word “hold,” this has become one of the most popular phrases in the cryptocurrency community. It essentially means to hold on to a cryptocurrency rather than selling. The term originated from a 2013 post on the BitcoinTalk forum by a user named GameKyuubi, who wrote, “I AM HODLING” during a rough day in the crypto markets. The typo caught on and became a meme within the community.

Over time, HODL has evolved into an acronym for “Hold On for Dear Life.”

It represents a mentality where an individual believes in the potential of a cryptocurrency, regardless of its current market volatility. HODLers are typically not swayed by short-term price drops or surges. They keep their holdings with the expectation of potential future gains.

In essence, when someone says they’re “HODLing,” they’re expressing their commitment to a zero-sum mentality (“moon or nothing”).

P.S. Want to know more about our favorite ways to invest in crypto — and how to do it? You need to see this…

Our team thinks a select few cryptos are about to go on another monster run. And we just released a bombshell briefing about how you can profit. Go here now to learn more…

This article originally appeared on StreetAuthority.com.