Positioning Your Portfolio for Higher Interest Rates

The abysmal start to the year continues. Year-to-date, the only sectors in positive territory are energy (+44.9%) and utilities (+1.9%).

At the other end of the scale, technology, communication services, and consumer discretionary sectors are all down at least 20% YTD.

The performance of utilities this year may be surprising, because utilities are one of the sectors that generally underperforms as interest rates are rising. However, the markets are always forward-looking. It was well-known in 2021 that interest rates were bound to rise, and utilities underperformed last year. Now that interest rates are actually moving higher, that news is priced in and the markets are looking toward the next phase of the business cycle.

The Business Cycle

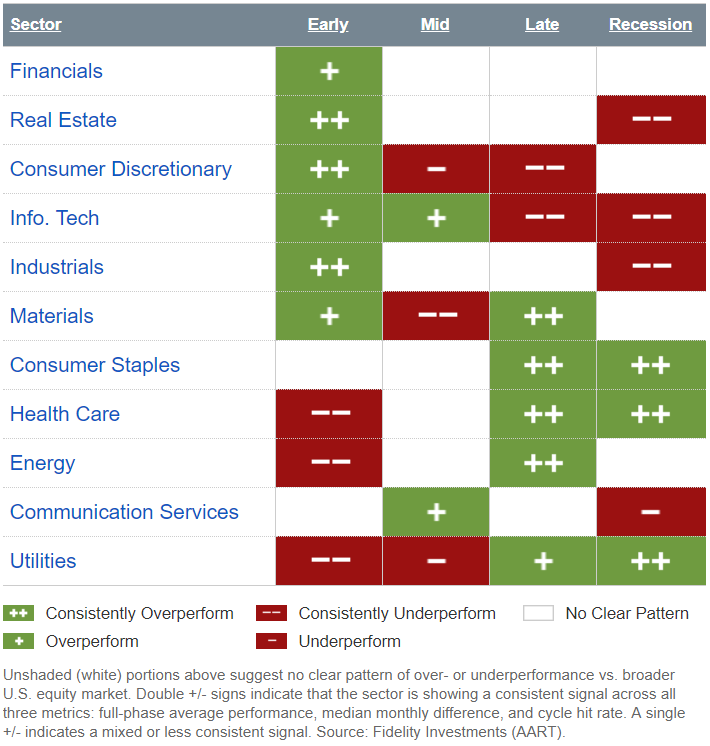

A typical business cycle has four phases that reflect different fluctuations of the economy: early cycle, mid-cycle, late-cycle, and recession.

The early cycle phase marks a strong recovery from a recession. Monetary policy is eased, and sales and margins expand.

During the mid-cycle, the economy experiences moderate growth. Profits are healthy, and monetary policy is fairly neutral. The stock market usually experiences consistent growth during this phase.

During the late-cycle, economic growth rates start to slow as credit tightens. This is the phase that we appear to have entered. The transition into this phase can result in increased stock market volatility.

Watch This Video: Where Are We in The Economic Cycle?

The final phase doesn’t always happen, but the recession phase is much more likely with high energy prices. Economic growth contracts during the recession phase.

Although my strategy is always to remain fully diversified at all times, some investors may try to time the business cycle. Different sectors historically perform differently during the different cycles. So it pays to understand what is likely to perform best in the late-cycle and in the possible recession to come.

There are five sectors that historically outperform during the late-cycle. Although three of the five sectors are down YTD, all have outperformed the S&P 500 (see table).

Source: Fidelity Investments

Three sectors have historically held up well during a recession: utilities, health care, and consumer staples. These sectors are of considerable interest during the late business cycle. Not only do they generally outperform during this phase, but they are consistent outperformers during the recession phase. If the current business cycle follows the typical pattern, then we are entering a period where these sectors are likely to outperform the broader markets for a period of several years.

If you are concerned about recession, but have a long time horizon, you might consider accumulating those sectors that tend to do well both during the late cycle and during a recession. Given the lofty valuations of energy stocks, it may make sense to move some of those energy profits into utilities, consumer staples, and health care.

Editor’s Note: Looking for a way to generate steady income, regardless of economic cycles and Federal Reserve policy? Consider our premium trading service: Rapier’s Income Accelerator, helmed by our income expert Robert Rapier.

Up, down, sideways… even in the face of rising interest rates… tech selloffs…overseas war…and anything else Mr. Market throws at you, Robert’s trades are income-generating machines. Click here now for details.