Navigating Rough Financial Waters

I am writing this article on Sunday, March 12. I add that for context, because there is potential for a wild day in the market on Monday, following last week’s events.

Last week, Federal Reserve chairman Jerome Powell told the Senate Banking Committee that the Fed may have to raise interest rates higher than previously expected in order to curb inflation.

It’s a familiar story, and the market reacted as it has before. Stocks took a dive in the second half of the week, and the S&P 500 closed down 5% for the week.

It looks like the bear market will linger for a while longer. Higher interest rates are a significant headwind for the market. It is unlikely that we will get a significant recovery until interest rates have stabilized, and there are indications that they may head lower.

There are a couple of famous adages in the market that are currently colliding. One is “don’t fight the tape.” That means don’t bet against the trend. In January it looked like the market was finally turning higher. The trend finally looked like it was heading higher.

But a more powerful adage is “don’t fight the Fed.” This phrase is attributed to Martin Zweig, a finance professor and investor. It means essentially “Invest according to the actions of the Federal Reserve.” If the Fed is raising interest rates, then proceed with caution. If interest rates are declining, prosperous times are more likely.

As if the warning of higher interest rates wasn’t enough, on Friday Silicon Valley Bank (NSDQ: SIVB) failed. This is the second-largest U.S. bank failure in history, trailing only the 2008 failure of Washington Mutual. Shares of SIVB — which were just touted a month ago as a good investment by CNBC’s Jim Cramer — fell 60% on the news.

WATCH THIS VIDEO: After SVB’s Collapse, Will The Dominoes Fall?

Significantly, many Silicon Valley firms had their money tied up in the bank, with assets well above the $250,000 FDIC insured limit. It’s too early to tell how bad the ultimate damage will be. But these two back-to-back events, in an already nervous market, significantly compound the risks for investors.

The failure of Washington Mutual was a harbinger of worse things to come in 2008. A significant recession was on the horizon. The S&P 500 was down nearly 40% in 2008. It is looking increasingly likely that we will enter into a recession within the next year or so. In fact, I would argue that the nearly 20% decline in the S&P 500 last year was anticipating an upcoming recession.

But how should investors play this? I think there’s a lot of downside risk, but I don’t believe in timing the market. I think what investors should do is a risk assessment of their portfolios. How would you fare if the market declines another 20%? If you could ride that out without an issue, then maybe you are suitably invested for your risk tolerance and time horizon.

If not, then it’s time to hunker down a bit. What does that mean? Ensure you have plenty of cash in reserve. This emergency fund should cover six months of expenses. If you have that covered, then invest defensively.

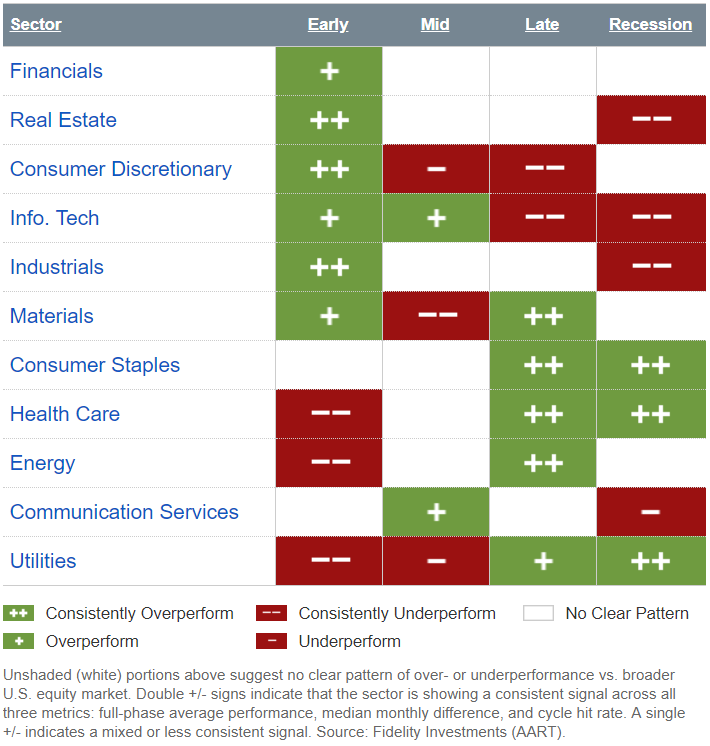

There are three sectors that historically fare best in a recession: Health care, consumer staples, and utilities. If you are underweight those sectors, you might shore up your coverage a bit. However, it’s also notable that utilities tend to struggle with higher interest rates, so take that into account. The utilities sector was the 2nd best performer in 2022, behind energy. But rising interest rates will provide increasing headwinds.

Source: Fidelity Investments

Sectors that do best historically leading up to a recession are those three sectors, plus energy and materials. The energy sector has had two straight years in which it blew away all other sectors. I don’t think that’s going to happen this year. But, if you are underweight the materials sector, you may want to shore up your coverage there.

This storm will pass, but the Fed is signaling that we still have a ways to go before we enter calmer waters.

PS: If you’re looking for a way to generate steady income with reduced risk, consider our premium trading service, Rapier’s Income Accelerator, helmed by our colleague Robert Rapier.

Robert can show you how to reap exponentially more income out of dividend stocks, by using his simple time-proven method. Click here for details.