Oil And Gas Growth: Look To NGLs

The age of Canadian oil and gas income and royalty trusts–popularly dubbed “Canroys”–is over. The era of dividend-paying Canadian energy stocks, however, is just beginning.

Plunging natural gas prices and the cost of converting from trusts to corporations wreaked havoc with sector dividends from late 2008 to early 2011. And yields fell further as rising energy prices pulled their stock prices higher.

Even after all that, however, several of the strongest former trusts still pay out 7 percent-plus. And after the market turmoil of the past month or so, weaker fare are pushing 10 percent.

Better, more than a few have again begun to increase dividends. As they’ve gotten used to operating as corporations, they’ve used surprisingly abundant cash flow to pay down debt and build strong production profiles.

Investors are not only seeing higher cash flow. But share prices are starting to head higher as well. And as reliable energy supplies globally become increasingly scarce that trend increasingly has legs.

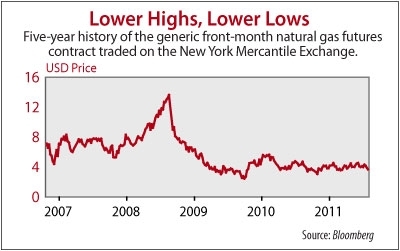

To date Canadian producer dividend growth has been almost entirely from those most heavily weighted to oil. It’s not hard to see why. The dramatic drop in natural gas prices since late 2005 is still an underappreciated drag on profitability for those weighted to gas. Despite a decided shift in Canadian producers’ capital spending to liquids production in recent years, gas still accounts for half or more of the production of many producers.

In late 2005 natural gas prices in

Companies like Cheniere Energy Inc (NYSE: LNG) made multi-billion dollar bets building capacity to import liquefied natural gas (LNG). Meanwhile, activity boomed in

Then came arguably the most revolutionary development in the energy industry since the modern drill bit: Producers at last cracked the code to unlocking oil and gas reserves theretofore trapped in shale rock.

The process–known as hydraulic fracturing, or “fracking”–is still controversial in some places. And some state and local governments in the

The unconventional natural gas revolution has set what appears to be a new baseline price for natural gas of somewhere around USD4 per million British thermal units. Prices still rise in winter and the peak summer cooling season, and they drop in off-peak spring and fall when air conditioners and heaters run less. But every push above or below the range seems to be met with resistance and support, respectively. And investors continue to react to the latest inventory numbers as evidence the market is becoming either more or less oversupplied.

Meanwhile, market sentiment for natural gas the commodity and natural gas producers could hardly be worse. One reason is almost total inability of North American producers to export via liquefied natural gas. That’s in large part the legacy of so much import capacity being built.

But, as noted in the InvestingDaily.com article, Asian LNG Demand and North American Exports, there are some projects underway to remedy that. One is the Kitimat project off the

That’s been a decided negative for gas producers in recent years, as shale production has surged and the market has appeared to slide into a semi-permanent state of oversupply. The glut could expand even further in coming months, should North American industrial sales (28 percent of total

Use of gas to generate electricity is on the rise throughout

Coal currently accounts for roughly half of

The US Nuclear Regulatory Commission (NRC) under President Obama has been a reliable champion for nuclear energy, approving license extensions for most of the currently operating plants. And it’s strived to keep construction of a new generation of plants on track, even as the Fukushima-Daiichi accident in

Even with all of that, however, nuclear power’s share of

That leaves natural gas-fired power to fill the breach as well as projected demand growth of at least 10 percent by 2020. Coupled with potential use of gas for fleet vehicles–a process slowly but surely taking shape across

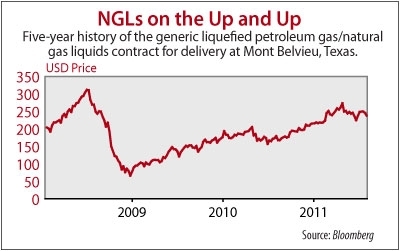

The problem is markets are notoriously impatient, and this is going to take time. Fortunately, there is one type of natural gas that’s already in a bull market: Natural gas liquids (NGL).

Enter NGLs

NGLs are naturally occurring elements found in natural gas, including propane, butane and ethane. By separating–or “fractionating”–these elements, producers can sell them separately. Because some are substitutes for oil, they fetch a much higher price than “dry” gas.

Ethane, for example, is used as a building block for polymers such as polyethene; polymers are key elements in the manufacturing of plastics. Availability of that NGL has made it very cheap to produce plastics in

Propane has long been used for home heating, particularly in rural areas not served by conventional natural gas pipelines. The NGL, however, is increasingly viewed for a much broader range of uses, including transportation and other industrial processes.

Butane’s uses for heating are also well known, particularly for campers and backpackers. But it also has a range of uses, including as a refrigerant, a feedstock for production of base petrochemicals in steam cracking, and as a propellant for sprays such as deodorants.

For much of their history NGLs have been an afterthought for producers, who were far more focused on oil and conventional natural gas. “NGLs on the Up and Up” shows why that’s no longer the case and explains why gas producers across the board are now focusing intently their output of NGLs.

At the same time natural gas prices have fallen sharply to flatten this year, NGLs have headed higher along with oil. And unlike dry gas, NGLs are ready for export once they’re separated. As a result they’re priced for the still-robust global oil market, rather than the landlocked and depressed dry gas market.

The ability to make lofty profits from NGLs has even made it worth companies’ while to scale up production of dry gas, just to get at the liquids that come along with it. To be sure, producers will do better if and when natural gas prices finally do start to pick up steam. But for now they’re seeing a strong new source of profits from “the other gas.”

To date much of the NGLs production surge has come from the lower 48 US states. But over the past few quarters we’ve seen Canadian companies step up to the plate, particularly the former royalty trusts. And much of the activity has been in the

One problem producers have had getting NGLs to market has been processing and transportation ability. That log jam, however, is beginning to break up, as energy infrastructure companies like Keyera Corp (TSX: KEY, OTC: KEYUF) and Pembina Pipeline Corp (TSX: PPL, OTC: PBNPF) step up their investment.

Oil-focused producers are still far more likely to raise dividends in coming months, just as they’ve been the only companies to boost the past couple years. But as NGLs become increasingly more important, even the laggards could start seeing growth, and that, in turn, will return share prices to the upside as well.

For an in-depth analysis of NGLs and their global impact, check out

Stock Talk

Add New Comments

You must be logged in to post to Stock Talk OR create an account