A Bullish Forecast For The Natural Gas Market Through 2012

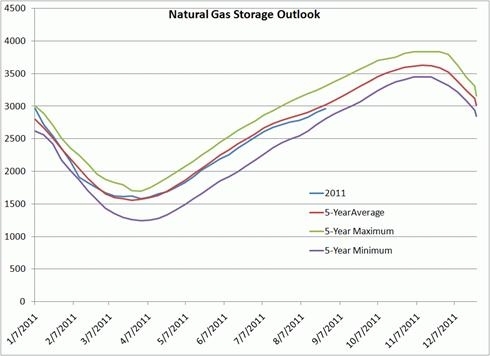

As I stated in my previous article The Natural Gas Oversupply and How to Play It, although the long-term outlook for demand and pricing remains favorable, the current supply overhang of natural gas is going to constrain prices for natural gas in the near term. As you can see in the graphs below, the supply side for natural gas lacks any meaningful catalysts for a durable recovery in natural gas prices.Weekly US natural gas storage statistics provide meaningful insight into the “closed” North American markets. Here’s a look at US working gas in storage relative to the five-year maximum, minimum and average storage levels.

Source: Energy Information Administration

The amount of natural gas in storage began 2011 near the five-year maximum–a symptom of a severe oversupply. During the winter months, storage levels declined to meet elevated demand for heating. By the end of this year’s winter withdrawal season, natural gas inventories were in line with the five-year average.

Meanwhile, storage volumes have increased at a slower-than-average pace this summer.

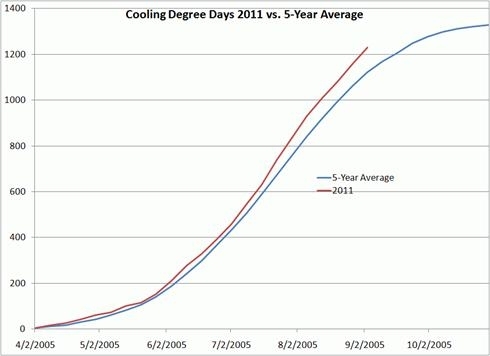

Normally, one would expect below-average supply to be supported with stronger prices; however, investors must scrutinize the factors behind the decline in gas storage levels relative to seasonal norms. In this case, an unusually hot summer is the culprit. Check out this graph of US cooling degree days (CDD), or the difference between a day’s average temperature and 65 degrees Fahrenheit. For example, if the mean temperature on a given day is 90 degrees, that would equate to a CDD of 25.

Source: National Oceanic and Atmospheric Administration

As of the most recent week’s data, summer 2011 has been about 9.6 percent hotter than the five-year average. In fact, July was one of the hottest months on record in the US. Natural gas is used to produce electricity and run air conditioning systems, hence above-average summer temperatures are behind the uptick in gas demand.

Traditionally, US demand for natural gas declines rapidly from mid-September to mid-November in advance of the winter heating season. Meanwhile, the supply of natural gas remains robust.

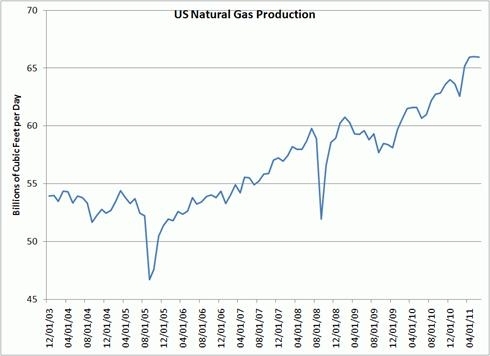

Source: Energy Information Administration

The US Energy Information Administration releases data on marketed US natural gas production with a three-month lag. As you can see, US gas output in May reached an all-time high of roughly 66 billion cubic feet per day, and production held steady in June.

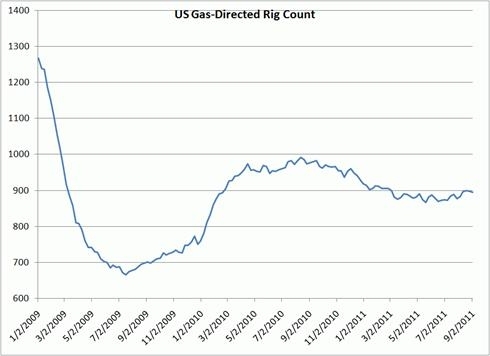

Producers continue to scale back their capital expenditures on gas drilling now that acreage in unconventional dry-gas fields such as the Haynesville Shale is held by production. Chesapeake Energy Corp, for example, has allocated 75 percent of its 2012 budget to liquids production–a business that offers superior margins–and only 25 percent on natural gas. In 2011 the firm spent roughly equal amounts on liquids-rich and dry-gas plays. The decreased investment in natural gas drilling is also visible in the US natural gas-directed rig count.

Source: Bloomberg

The number of rigs targeting natural gas dropped off sharply when commodity prices collapsed in late 2008-09. Despite depressed natural gas prices, the rig count stabilized and began to increase into mid-2010. This apparent disconnect between natural gas prices and drilling activity stemmed from contracts that required operators to sink a commercially productive well within a specified time frame to extend their lease hold. Producers also stepped up drilling in plays that contained high-value natural gas liquids ((NGLs)) such as ethane, propane and butane.

Since mid-2010, the US gas-directed rig count has declined by about 10 percent. But this drop hasn’t restricted US natural gas output. In fact, US gas production has accelerated. As producers gain experience in the nation’s shale gas plays, the efficiency of their drilling operations has improved immensely. Today, operators sink wells at a much quicker pace and have optimized their drilling and hydraulic fracturing techniques to maximize output.

Producers have also shifted rigs from higher-cost fields to the most prolific plays. In the hottest unconventional plays, producers continue to benefit from the relatively high value of NGLs contained in raw natural gas streams. (See Why Some Natural Gas Is Worth $7.28.)

These trends appear to have lowered the equilibrium price for natural gas–the price at which producers are incentivized to ramp up drilling–to the neighborhood of $5 per million BTUs from as high as $7 per million BTUs. Some gas-producing fields are even profitable when gas goes for less than $4 per million BTU.

Adjustments on the supply and demand side eventually will return natural gas prices to between $5 and $6 per million BTUs. Low prices and lower CO2 emissions will drive the shift to natural gas-fired plants, while industrial users will also increase their use of natural gas. Supply growth should also level out as producers allocate more money oil-rich plays.

But natural gas prices will remain constrained in the near term. Lately, the US gas-directed rig count has stabilized and ticked slightly higher. As demand for natural gas moderates in the fall shoulder season, expect the volume of natural gas in storage to exceed the five-year average.

The prospect of hurricane-related shut-ins has also buoyed natural gas prices in recent weeks. Tropical Storm Lee dumped a deluge of rain across the Gulf Coast, forcing operators to temporarily evacuate some rigs and interrupting gas processing operations in the region. This disruption could cause a temporary dip in US natural gas and oil inventories, causing natural gas prices to rally. However, these gains will evaporate once hurricane season winds down.

My current forecast calls for the 12-month strip for Henry Hub prices to hover around $4 to $5 per million BTU, though prices could pull back dramatically when gas storage volumes rise to above-average levels.

If natural gas output moderates in 2012, we will consider adding some exposure to North American producers. At this point, there’s no sign that supply overhang will subside.

Note that we remain bullish on international markets for natural gas. Not only does LNG demand continue to increase in emerging markets, but Germany’s decision to phase out its fleet of nuclear reactors will also force the country to increase its reliance on natural gas. A tightening supply-demand balance has pushed natural gas prices in the UK to roughly $11 per million BTUs, while supply contracts in Asia are often indexed to the price of Brent crude oil.

Stock Talk

Add New Comments

You must be logged in to post to Stock Talk OR create an account