TransCanada: Biggest Opportunity Not Yet Reflected In Share Price

Over the past month, the U.S Energy Information Administration (EIA) has substantially reduced its projections for global energy demand growth in 2011 and 2012. That’s based largely on a lowered forecast for U.S.GDP growth from 2.4 to 1.5 percent this year and from 2.6 to 1.9 percent next.

Even so, however, the EIA still expects global oil prices to average well over USD100 a barrel the next two years. The reason: continued robust demand growth in Asia, despite worries about government efforts to control inflation.

The vast majority of Canada’s oil and gas exports have historically flowed to the U.S. through some 62,000 miles of pipeline. Just three companies currently own the vast majority of this network. Two are Canadian:Enbridge Inc and TransCanada Corp. The other is U.S. master limited partnership Kinder Morgan Energy Partners LP.Spectra Energy also owns a chunk of capacity.

The main reason for the U.S. bias is geography; it’s far cheaper to ship energy over pipelines to meet U.S. demand than to transport oil, liquefied natural gas or natural gas liquids (NGLs) overseas by ship. Also, each of these companies’ networks is interconnected with the tens of thousands of pipeline miles and processing facilities in the U.S.

The U.S. is certain to remain Canada’s primary market in coming years, particularly if TransCanada’s Keystone XL pipeline is built. The new pipeline would carry as much as 900,000 barrels of oil a day over roughly 1,700 miles from Hardisty, Alberta, through parts of Montana, South Dakota, Nebraska, Kansas and Oklahoma, with a final destination of refineries in Texas.

Keystone XL would for the first time unlock significant amounts of oil mined from Canada’s oil sands for both the U.S. and global markets and create a potentially huge amount of business for U.S. refiners in the bargain. As a result, the project has drawn fervent opposition on the grounds that will encourage accelerated development of so-called “dirty oil.” Others have raised concerns that the proposed route will endanger health and safety where it passes, including a major aquifer providing more than 80 percent of Nebraska’s population with drinking water.

Last month the U.S. Department of State released its long-awaited environmental impact statement on the pipeline, finding that TransCanada had put in place all needed measures to ensure safety and that any contamination from potential spills would be localized. That would seem to ensure that State will grant final approval for the project later this year.

Opponents — who now include the Dalai Lama — haven’t given up yet, however. And it’s possible President Obama will overrule his State Department and order the pipeline plan rejected, particularly with his campaign for re-election kicking off. On the other hand, building Keystone XL is projected to stimulate USD20 billion of investment in the U.S.economy and the creation of some 118,000 jobs. That may make it tough for a president facing high unemployment to reject. You can read David Dittman’s excellent article, “North American Energy and U.S. Jobs,” for more on Keystone XL and to uncover another high-quality, high-yield pipeline play.

Should the pipeline be approved, the big winner will be TransCanada. Capital spending and earning a return on it is the key to every energy infrastructure’s company’s growth. And the new capacity is sure to be fully subscribed, ensuring a hefty return on a record-large investment.

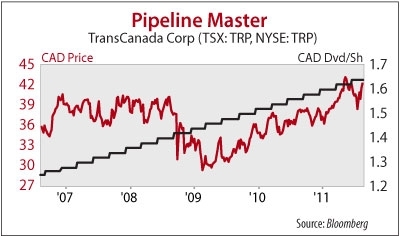

Best of all for investors, the controversy surrounding the pipeline means the potential earnings gain isn’t yet reflected in its share price. As a result the yield is nearly 4 percent, and the stock sells for only about 1.9 times book value, despite posting a 30 percent boost in earnings in the second quarter, after taking out one-time items.

That’s the result of the company’s robust capital spending program beyond the Keystone plans, including new gas pipelines brought on stream in the past 12 months in Alberta Mexico and the U.S. West. The company has also started up new power plants in Arizona and Ontario, all of which are now generating cash flow.

This spending plan will continue to boost TransCanada’s earnings, dividends and, eventually, its share price, no matter what happens at Keystone. And if the pipeline is approved and built, growth will be that much faster.

Stock Talk

Add New Comments

You must be logged in to post to Stock Talk OR create an account