Finding Yield In U.S. Royalty Trusts: SandRidge Mississippian Trust I

High-yielding Canadian royalty trusts have been tremendous moneymakers over the years, though most converted to regular corporations because of an unfavorable change in the tax code.

Despite the change in tax treatment, many the former Canadian trusts still offer high yields and significant growth potential. My colleague Roger Conrad covers the group in great detail in Canadian Edge.

Investors often ask about the prospects for high-yielding US-listed trusts, especially BP Prudhoe Bay Royalty Trust. Since this royalty trust began trading in 1989, it has generated enormous wealth for investors.

Source: Bloomberg

Source: Bloomberg

As we first noted on our Facebook fanpage, if you purchased this security for $26 per share in 1989, you would have collected more than $95 worth of distributions over the ensuing 22 years. If we factor in capital gains and assume you reinvested the distribution to buy additional units, you’d be sitting on a roughly 5,000 percent return–an annualized gain of almost 20 percent in a market that has gone nowhere over the past decade.

Outperformance of this magnitude merits a second look.

US-listed royalty trusts aren’t subject to corporate taxes. The trusts pass through the income and profits earned to individual unitholders who pay tax on their share of the income. This prevents the double taxation that occurs when the Internal Revenue Service (IRS) taxes dividends at the corporate and individual level.

Like MLPs, trusts incur significant depreciation and depletion charges that provide a tax shield. The IRS considers part of the distribution you receive as a return of capital. You won’t be taxed on that portion of your distributions until you sell your units.

In contrast to MLPs and Canadian royalty trusts, US-listed oil and natural-gas trusts are finite entities that convey the right to unitholders to collect royalties from a specific group of wells, fields or geologic formations. The trust can’t add to these properties over time by acquisition or expansion.

As these wells mature, declining oil and gas output will force the trust to reduce the amount it pays out. Most trusts are set up with a pre-determined termination date, at which point the assets will be liquidated and the proceeds distributed to investors.

With about 15 publicly traded US energy trusts on the market, investors have limited options from which to choose. Investors must scrutinize each trust’s financial and registration statements to determine which names offer the best potential returns and payout schedule.

I favor trusts that have launched more recently; they tend to have a longer life span ahead of them, and payouts often grow more rapidly in the early years. Many trusts are also structured with hedges and other safeguards that reduce immediate exposure to commodity prices and facilitate reliable distribution growth.

SandRidge Mississippian Trust I went public in April 2011 and owns royalty interests in 37 horizontal wells producing oil and natural gas from the Mississippian formation in Oklahoma and a stake in 123 additional horizontal wells to be drilled over the next few years by the grantor, SandRidge Energy. All of these wells are located on a 64,200 acre “area of mutual interest” (AMI) in Oklahoma’s Alfalfa, Garfield, Grant, Major and Woods counties.

Here’s how the royalty structure breaks down.

1. The trust is entitled to receive 90 percent of all proceeds from the sale of oil and natural gas associated with the existing 37 producing horizontal plays after deducting post-production costs and taxes. The remaining 10 percent is paid to SandRidge Energy.

2. The trust is entitled to receive 50 percent of the proceeds from the 123 wells scheduled to be drilled over the next few years, with the balance paid to SandRidge Energy.

Note that SandRidge Energy doesn’t own a 100 percent interest in all the wells covered by the trust. In these cases, trust’s share of a particular well’s proceeds will be adjusted according to its stake in the particular well.

SandRidge Energy is required under the terms of the trust to drill the 123 additional wells on the AMI properties by Dec. 31, 2014, though that deadline can be extended by one additional year under certain circumstances.

A horizontal well’s productivity depends in part of the length of the well’s laterals, or the horizontal segment that intersects the oil and natural gas reservoir. The terms of the trust stipulate that only wells with a perforated lateral segment–the portion of the well that produces oil and gas–of at least 2,500 feet will count toward the 123 wells. In addition, SandRidge must have at least a 57 percent working interest in each well.

The trust structure also includes offsets to these requirements. For example, SandRidge Energy could reduce the number of wells it must sink by drilling longer laterals and focusing on projects in which it has a higher ownership stake.

Note that the trust itself isn’t responsible for the costs associated with drilling these 123 new horizontal wells, limiting trustholders’ exposure to the rising cost of hydraulic fracturing and other critical production services.

However, the trust is liable for its share of the post-production costs, including gathering and processing fees. Administration expenses associated with running the trust also reduce trustholders cash receipts. In general, post-production and administration costs are significantly lower and far more predictable than operating and drilling costs.

This trust stands out because of two other risk-reducing features.

At the time of its initial public offering, the trust had hedged roughly 54 percent of its planned production and 60 percent of its estimated revenue between April 1, 2011, and Dec. 31, 2015. Management expects the trust’s output to be split evenly between oil and natural gas. The trust has hedged about 40 percent of its gas production and around 70 percent of planned oil output through 2015.

These hedges offer significant near-term protection from fluctuations in commodity prices, while offering exposure to oil and gas prices after 2015–a potential upside catalyst.

Although I expect oil prices to remain elevated over coming years because of rapidly increasing global demand and constraints on supply growth, my intermediate- and long-term outlook for US natural gas prices remains sanguine. This stance might come as a surprise to readers, as I remain bearish on domestic gas prices in the near term.

But the coming years will be kind to natural gas. With rising concern about carbon dioxide emissions, US utilities are increasingly turning to natural gas-fired power plants to boost baseload capacity. Meanwhile, nuclear reactors take far too long to build, while alternatives only generate power intermittently and can’t add baseload power to the grid.

The nation’s vast gas shale reserves also make it difficult to envision a world in which domestic demand for natural gas doesn’t improve over the long term.

In short, the trust’s structure ensures a reliable income stream in the early years and the potential for additional upside after 2015. I also like that SandRidge Energy has retained ownership of 3.75 million shares in the trust, equivalent to a 17.8 percent stake. The parent company will receive the same distributions as individual holders.

In addition, SandRidge Energy owns 7 million subordinated shares that will pay out a regular distribution only if the trust generates sufficient cash flow to disburse at least 80 percent of the targeted quarterly distribution. If quarterly cash flow falls short of this threshold, the subordinate shares will forego part or all of their contingent distribution, until common shareholders are made whole.

These 7 million subordinate shares account for 25 percent of outstanding shares (21 million common shares and 7 million subordinated shares), providing a substantial cushion against shortages in cash flow.

However, SandRidge Energy does receive a carrot for providing this cushion. When distributions exceed 120 percent of their targeted quarterly amounts, the subordinated shares entitle SandRidge Energy to a 50 percent bonus on all amounts over this threshold. The subordinated units will convert into common units four calendar years from the date that SandRidge Energy completes its obligation to drill those 123 wells.

Although these subordinated units limit potential upside when quarterly distributions are high, the downside protection that this structure provides in lean times is a welcome offset. In addition, the size of SandRidge Energy’s bonus should incentivize the company to exceed the 120 percent distribution threshold as often as possible by accelerating drilling activity.

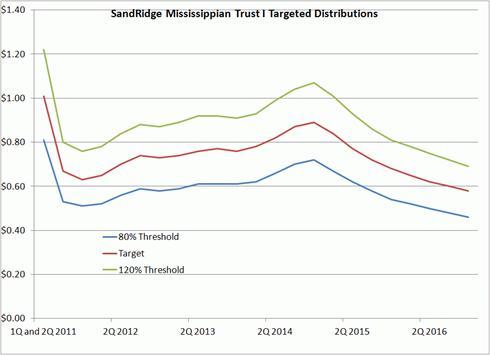

Let’s look at the trust’s targeted quarterly distributions.

Source: SandRidge Mississippian Trust I Form S-1/A Registration Statement

Source: SandRidge Mississippian Trust I Form S-1/A Registration Statement

This graph tracks the targeted quarterly distributions for the SandRidge Mississippi Trust I through to the final quarter of 2016. The upper line represents the 120 percent threshold; the lower line represents the 80 percent payout threshold.

Note that the trust’s registration statement calls for the distribution to rise through the end of 2014 and decline thereafter. That’s because the terms of the trust require SandRidge Energy to drill these 123 new wells by 2014; production should increase as new wells come onstream, boosting the payout. Once new drilling ceases, oil and gas output will begin to decline until the trust expires in 2030, at which point it well sell its remaining assets and distribute the proceeds.

The potential upside comes from better-than-expected drilling results and/or higher-than-expected commodity prices.

Since the initial public offering in April, SandRidge Mississippi Trust has paid out one distribution– $1.068461 per unit, disbursed on Aug. 30, 2011. This amount is above the scheduled target distribution, but a bit shy of that 120 percent threshold. Based on this early performance, the trust appears on track to meet or exceed the targeted levels.

Assuming the trust manages to pay out according to its scheduled target over the next year, the common shares yield roughly 12 percent. The equivalent 80 percent and 120 percent payout thresholds would result in yields of 9.5 and more than 14 percent, respectively.

In addition to the incentives associated with the subordinated shares, SandRidge Energy plans to spin off other assets as a means of funding its drilling programs. If this initial foray generates solid returns for investors, the company should have little trouble raising capital via a similar trust.

For these reasons, I expect the trust’s distributions to meet or exceed 120 percent threshold more often than not. The potential returns in this scenario are impressive. Between now and 2016, the trust could disburse between $16 and $19 in distributions per unit. Elevated oil prices and rapid distribution growth could also drive up the price of the common shares. Energy trusts and MLPs often post their best returns in their first few years of public trading because rising distributions tend to drive capital appreciation.

SandRidge Energy’s production estimates for the 123 wells it will drill in the Mississippian appear reasonable. This play has been in production for decades, so the geology is well-known. Previous activity in this formation focused on vertical wells, but horizontal wells have given the play a new lease on life.

Although not enough horizontal wells have been drilled in the region to produce reliable production and decline curves, SandRidge Energy is an experienced operator and thus far drilling activity has yielded consistent results. SandRidge Energy may have low-balled the trust’s production potential slightly to generate above-average distribution growth,

The stock has pulled back from its early August high amid volatility in the broader market and shouldn’t drop below $19 to $22, assuming a barrel of West Texas Intermediate crude oil doesn’t tumble into the low $70s. When WTI claws its way back to $90 per barrel, the stock could rebound into the high $20s.

SandRidge Mississippian Trust I is a more aggressive income play than Linn Energy, which boasts a more robust hedge book and continues to grow through acquisitions. But the significantly higher yield offered by the trust offsets these risks.

Note that SandRidge Mississippian Trust is taxed as an MLP, so you will receive a K-1 form at tax time. Part of your income will be considered a return of capital and will not be taxable until you sell the trust. The rest will be considered ordinary income and taxed at your marginal income tax rate. For more details, on the K-1 forms and the tax treatment of MLP-like structures, check out Master Limited Partnerships and Taxation

Stock Talk

Add New Comments

You must be logged in to post to Stock Talk OR create an account