Looking For A Rebound In This Hard-Hit Coal ETF

Bears expected to finally savor victory in the third quarter. They were hoping to take advantage of the market’s turmoil due to investors’ fear over the sovereign debt crisis in Europe, the fiscal showdown in the US and the potential for slowing growth in China. The S&P 500 (SPY) descended into a classic correction in August and approached bear market territory.

But the S&P 500 failed to accommodate the bears when it fell 15.1 percent in the quarter before finally rebounding in early October. Meanwhile, the MSCI EAFE Index–which tracks the performance of global equity markets–narrowly avoided entering a new bear market with a decline of 19.4 percent.

This crisis of confidence has taken its greatest toll on the energy sector, which declined by more than 20 percent in the third quarter. Nevertheless, I’m maintaining exposure to the energy sector because my long-term view of the sector remains unchanged.

Fundamentals Intact

The European sovereign debt crisis has put a serious damper on energy demand. If the situation were to spiral out of control, nations such as Greece, Spain, Ireland or Italy could default, which would decimate the European banking system and plunge the world into a deep recession.

I believe the Europeans will eventually work to resolve this crisis, and we’re finally seeing signs of such effort. France and Germany have agreed to work together to formulate a plan to recapitalize troubled banks, a critical first step in unwinding the region’s debt crisis. While the two major European powers aren’t the sole decision makers and the path to resolution will be bumpy — Slovakia’s recent failure to back the plan for an expanded role for the European Financial Stability Facility is an excellent example of that — Europe’s problems will be resolved and the European Union will emerge intact. The consequences of a failure to act would simply be too dire for the Continent to allow a cascade of defaults to unfold.

So I continue to believe that energy will remain in a bullish secular trend, and data from the US Energy Information Administration (EIA)supports this view.

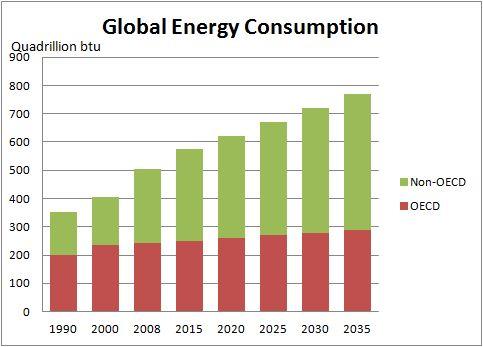

Source: EIA

The chart above depicts the EIA’s forecast for global energy demand through 2035. It’s an excellent visual representation of the fact that energy demand growth will largely be driven by emerging market demand. The bottom red bar represents demand forecasts from the member states of the Organization for Economic Cooperation and Development (OECD), an organization primarily comprising developed-market states. While the OECD member states forecast slight growth in energy — about 50 quadrillion British thermal units (btu) over the next two decades — the vast majority of growth will come from the non-OECD states in the emerging markets. In fact, energy demand from those countries is projected to grow by more than 220 quadrillion btu by 2035.

That’s a trend that can’t be ignored.

King Coal

Concerns about future Chinese growth largely fueled the sharp decline in coal over the course of the quarter. According to estimates, China produced roughly 3 billion tons of coal last year, but it consumed around 3.3 billion tons, making it both a major producer and importer. Coal accounts for about 83 percent of the country’s energy consumption. Given that China is one of the world’s largest consumers of coal, many believe that as China goes, so goes coal.

There’s certainly some truth to that, if for no other reason than perception often becomes reality in the market. However, the growth in coal consumption is hardly limited to China. China contributes a great deal to the demand curve, but aggregate demand from other emerging markets accounts for the majority of demand.

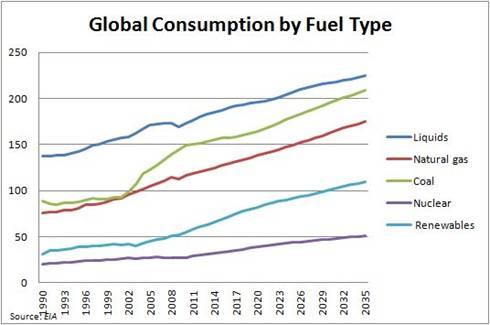

The graph below shows the EIA’s estimates for energy consumption based on fuel type. While liquids such as oil account for the bulk of energy consumption due to transportation demand, demand for coal is expected to grow at the fastest rate of any energy source. Given this trend, it’s no wonder a serious investor like Warren Buffett is betting big on coal.

Although global economic activity has undeniably slowed over the past couple of quarters, consensus analyst expectations still forecast emerging market GDP to grow by more than 6 percent this year and next. And that forecast even accounts for a slight slowdown in China. An abundant source of inexpensive energy such as coal is needed to fuel that rapid growth. So coal will remain the energy source of choice for emerging markets.

Even if the developed world were to slip into another recession — again, a scenario I consider unlikely — coal demand will likely remain stable. At the height of the recession in 2008, for example, global coal demand still rose by 4.2 percent. Also, as my colleague David Dittman shows in his InvestingDaily.com article, takeover offers in the coal sector are continuing to push up prices of companies with strong fundamentals.

Market Vectors Coal ETF (NYSE: KOL) is an interesting option for exchange-traded fund investors seeking exposure to the global coal market. Rather than building its coal exposure through futures positions, Market Vectors Coal ETF invests in companies that derive at least half of their revenue from the coal industry. The fund’s holdings cover all aspects of the coal industry, from miners to equipment manufacturers. The ETF is also geographically diversified, though Asia looms large in the fund’s performance. About half of the fund’s assets are devoted to US-based companies, a play on rising US coal demand and growing exports to Europe.

Stock Talk

Add New Comments

You must be logged in to post to Stock Talk OR create an account