Newalta Corp: Shaky Markets Hiding Immense Value

Energy stocks were among the hardest-hit victims of the summer sell-off. Investors will long remember oil’s drop from over $150 to less than $30 a barrel in just a few months. And as worries about a new credit crunch/recession surfaced, many moved quickly to lighten up on the sector.

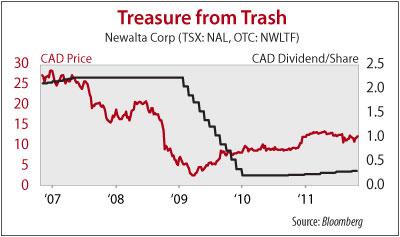

Newalta (NWLTF.PK), was one of the stocks to get hit, slipping to $9.40 from a mid-summer trading range of $12 to $13.

The stock has bounced back since, but still remains extremely cheap. Newalta trades for barely book value and just 89 percent of sales.

Most important, nothing has happened this year to dim the growth prospects of this company. Rather, the current low price is due to overstated risks related to macroeconomic fears, which management has largely prepared against. That means powerful upside when confidence returns to the market and little real downside risk so long as it’s absent.

Newalta Corp’s robust third-quarter earnings are a stark contrast to the ups and downs of its share price the past few months. Revenue surged 25 percent from year-earlier levels, while gross profit as a percentage of sales rose from 24 to 25 percent. Headline earnings per share doubled. More important, funds from operations–the account from which dividends are paid–soared 57 percent. And the company doubled capital spending on growth, setting the stage for even better returns in 2012 and beyond.

Newalta’s current strong growth is the result of its multi-year strategy to expand industrial and oilfield waste cleanup and recycling operations across Canada. Management even continued to follow that strategy despite a drop in its share price to barely USD2, when it converted to a corporation at the worst of the credit crunch/recession of 2008-09.

As a result Newalta is now the premier Canadian pure play in cleanup and recycling of industrial and oilfield waste. That includes the oil sands, where the company has entered an exclusive contract to clean up sites and recycle waste for the Syncrude partnership. Operated by the Canadian unit of Exxon Mobil (NYSE: XOM), Syncrude has plans for aggressive expansion in coming years. And Newalta’s three-year contract to process mature tailings near Fort McMurray, Alberta, has put it in prime position to grow along with Syncrude.

Newalta’s customers today range from refining and petrochemical companies to miners and a range of heavy industry. These are fundamentally dirty businesses that have a constant need to dispose of waste safely, particularly as environmental regulations tighten. And the larger the company has grown, the greater its ability has become to compete for contracts with major players like Syncrude.

New contracts boost fee income and provide waste for the company to recycle into saleable products, such as fuel oil. Higher prices for recycled products contributed about 10 percent of third-quarter earnings growth.

The other side of the coin is that heavy industry and energy producers operate in cyclical businesses that are affected by the pace of global economic growth. As a result the sharp contraction of 2008-09 hit Newalta’s business hard, particularly the operations and facilities servicing the energy industry, as its customers pulled back on activities in the face of falling oil and gas prices.

Newalta’s saving grace during that time was management’s tight controls on operating costs, particularly on where it spent its capital. That remains a constant discipline with every new investment decision. And it’s paid off with a robust 15 percent return on capital this year, up sharply from last year’s 12 percent.

Looking ahead, management is squarely focused on growth via a pipeline of organic growth projects, which basically expand capability in areas where the company already operates. That includes lead acid recycling and sales serving eastern Canada’s industrial base, cleaning up and recycling waste from directional drilling of oil and gas and growth of oil sands activity.

Management anticipates return on capital will rise to 18 percent by the end of 2011, with a rising number of onsite services contracts powering similar gains in 2012. And more than 90 percent of earnings will come from fee-based activity, limiting exposure to ups and down of commodity prices.

There is a CAD115 million convertible bond that matures Nov. 30, 2012. The security currently trades at about twice conversion value in stock, meaning the company will likely have to roll over the full amount.

Happily, the company also has a CAD200 million credit facility on which it’s currently only about a quarter drawn. That facility matures Dec. 17, 2013, so the company could pay off the convertible without accessing capital markets in a worst-case.

In addition, Newalta generated CAD97.4 million in funds from operations in the first nine months of 2011. That covered capital spending plus dividends by a 1.17-to-1 margin, meaning the company has ability to fund at least a portion of maturing obligations from cash flow as well.

Newalta shares currently trade for barely a third their all-time high, set Oct. 20, 2006. That was, of course, just days before Canadian Finance Minister Jim Flaherty announced his infamous tax on trusts.

The company, however, is arguably far more valuable now as a corporation than it was then as an income trust. And as it continues to grow its business going forward, it will only become more valuable, potentially as a takeover target.

That kind of value ultimately means very real upside. And it’s why I’ve stuck with this stock over the years, even though it pays the lowest yield in my Canadian Edge portfolio (2.6 percent). That payout was boosted 23 percent in July, and it’s headed a lot higher in coming quarters.

But the real appeal of this one is potential for explosive capital gains. And for patient investors with that objective, there are few better bargains now.

Stock Talk

Add New Comments

You must be logged in to post to Stock Talk OR create an account